Deprecated: Function get_row_css_class is deprecated since version 4.2 (will be removed in 6.0) with no alternative available. in /home/danielfp/public_html/newsite/wp-includes/functions.php on line 6085

Features

Back-testing

Live Trading

How it works

Notice: Undefined property: WPBakeryShortCode_Vc_Tab::$predefined_atts in /home/danielfp/public_html/newsite/wp-content/themes/better/includes/extend-vc/vc_templates/vc_tab.php on line 3

Warning: Invalid argument supplied for foreach() in /home/danielfp/public_html/newsite/wp-includes/shortcodes.php on line 667

Our programming framework (which we call F4) was created in order to allow for the fast, flexible, platform independent and powerful creation of trading strategies, primarily for Forex trading. The aim was to rid ourselves from the limitations imposed by platforms like MT4/MT5, etc. These are the F4 framework’s features

- Fast execution (C/C++)

- Source code fully available

- Platform independent (Windows/Linux/MacOSX)

- Powerful severity specific logging using Pantheios

- Trading platform independent (call the strategies from any trading platform that can call external libraries without the need to recode). Right now we have implemented 3 front-ends MT4/Mt5/AsirikuyTrader. The Asirikuy Trader program can be used to trade in Oanda (Java and REST API) or Dukascopy (JForex API). Code once, trade everywhere.

- Includes OpenSource libraries (FANN, Gaul, Shark, Waffles, DevIL, Jasper, etc)

- Calculate many common indicators using TA-lib

- Licensed library used for charting and general graph creation (chartDirector)

- Easily code strategies that would otherwise be very complicated to code (such as dynamically training machine learning systems)

- Easy creation of constant range (renko)/volume arrays

- Get daily data from Yahoo/Quandl with a single code call. Behavior is the same under live/back-testing so you can easily back-test strategies containing data outside of your FX instruments.

- Load data from multiple symbols and/or timeframes.

- Dedicated back-testing library

- Automatic NTP time detection and automatic correction and data refactoring against any broker’s time definition (in summary, ensure data always has the same timestamp and weekly opening/closing times for the system, regardless of the broker used).

- More than 15 different sample strategies, including machine learning strategies using regression mechanisms, neural networks, etc. Strategies include volatility breakout strategies, universal breakout strategies, counter-trending strategies, etc.

Notice: Undefined property: WPBakeryShortCode_Vc_Tab::$predefined_atts in /home/danielfp/public_html/newsite/wp-content/themes/better/includes/extend-vc/vc_templates/vc_tab.php on line 3

Warning: Invalid argument supplied for foreach() in /home/danielfp/public_html/newsite/wp-includes/shortcodes.php on line 667

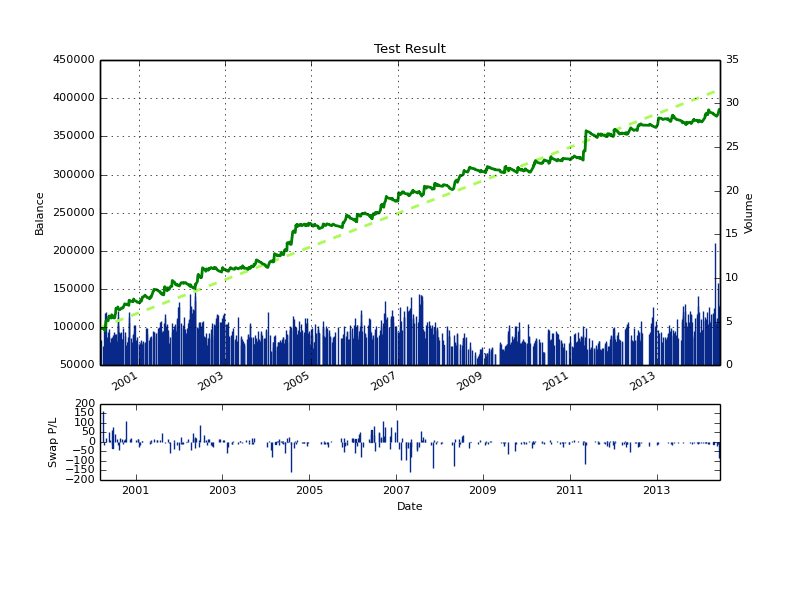

Our New Strategy Tester (NST) is a python back-tester that you can use to back-test F4 trading strategies outside of any particular front-end. Here are the features of our back-tester:

- Platform independent (run back-tests on Windows/Linux/MacOSX)

- Coded in python (source code fully available)

- Back-test single systems using either OHLC data or tick-by-tick data

- Define the spread/slippage/contract size and other relevant back-testing variables

- Include swaps using historical interest rates (no need for constant swap assumptions through your test)

- Generate graphs with regression lines, swap, volume and balance information.

- Generate HTML report with statistical information.

- Run back-tests using data from multiple time frames and/or multiple symbols

- Back-test system combinations (portfolios) even across multiple symbols.

- Brute force optimizations

- Optimize systems using the powerful Gaul genetic library.

- Optimize towards any desired target.

- Open MP support (optimize using any number of computer cores)

- MPICH support (optimize using several different computer nodes)

Notice: Undefined property: WPBakeryShortCode_Vc_Tab::$predefined_atts in /home/danielfp/public_html/newsite/wp-content/themes/better/includes/extend-vc/vc_templates/vc_tab.php on line 3

Warning: Invalid argument supplied for foreach() in /home/danielfp/public_html/newsite/wp-includes/shortcodes.php on line 667

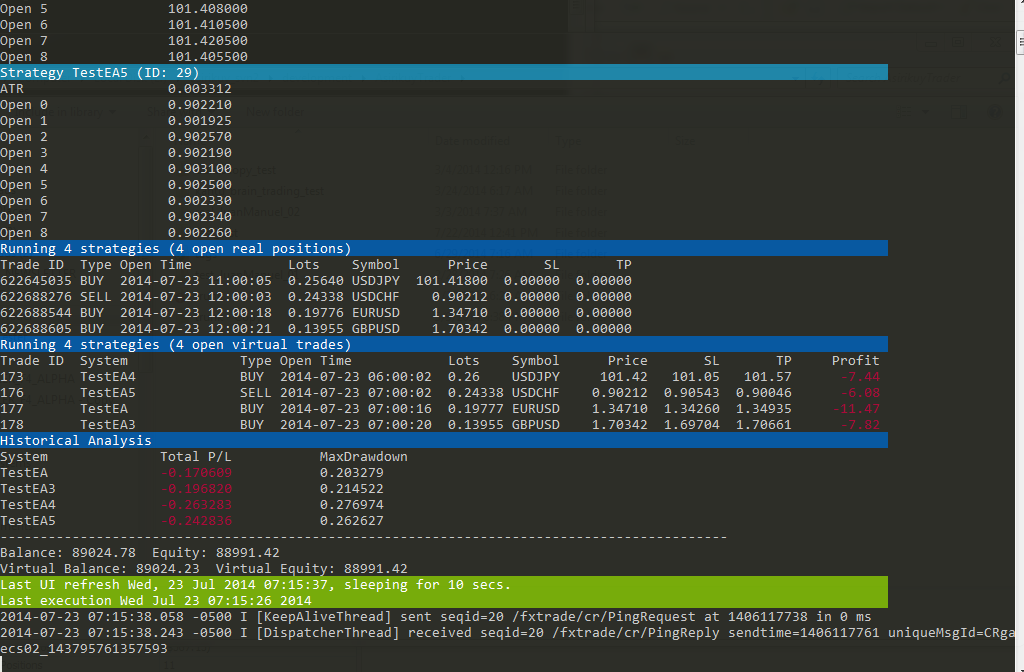

Currently F4 framework systems can be executed across three different live trading front-ends (MT4, MT5, Asirikuy Trader). The Asirikuy Trader is the trading software we have developed at Asirikuy for live trading outside of MT4/MT5. Here are the features of our live trading software:

- Platform independent (live trade on Windows/Linux/MacOSX)

- Coded in python (source code fully available)

- Console program for fast execution

- User interface showing key account values and F4 system UI values

- Trade on Oanda (REST/Java API) or Dukascopy (JForex)

- Internal OrderWrapper allows for the trading of multiple systems on Oanda, despite the broker’s net positioning approach (only one position per symbol). The program manages all virtual orders internally and consolidates them against real positions.

- Trade any number of systems.

- Error emailing system, receive an email in case of any error within the trader (provided there is a viable internet connection). You can also configure the severity of the errors you receive.

Notice: Undefined property: WPBakeryShortCode_Vc_Tab::$predefined_atts in /home/danielfp/public_html/newsite/wp-content/themes/better/includes/extend-vc/vc_templates/vc_tab.php on line 3

Warning: Invalid argument supplied for foreach() in /home/danielfp/public_html/newsite/wp-includes/shortcodes.php on line 667

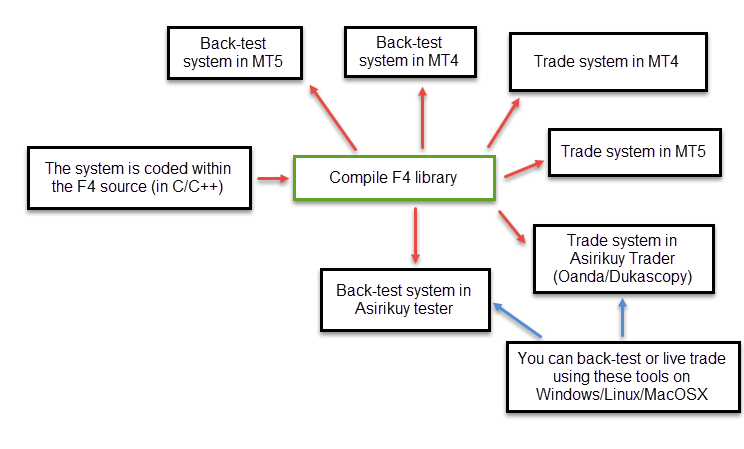

Using the F4 framework to build systems is a convenient and powerful approach to the development of trading strategies. All systems built within the F4 framework are compiled into a single shared library and the library is then called from a front-end on the desired trading platform. The image below highlight the steps to use the F4 framework to create new systems. After compiling your F4 library you can back-test or live trade your system within a wide variety of platforms.